· admin · Q&A · 8 min read

Steve (aka Snorm)

Trader / Coder of trading tools / Trading Coach

Intro

Our first trader up for the questions is Steve. Steve has been a great mentor and really shows how trading can be mastered. A big thank you for given up his time to complete these questions and also kindly allowing me to access to his trading group to ask some very experienced traders the same questions. (Answers coming soon). More about Steve, trading tools and trading group can be found at his website.

A bit about yourself

About me

I’ve been a full time trader for many years and a coder of trading tools for even longer. I enjoy helping others to succeed at trading. My number one goal, with trading, is to create robot to do all the trading for me, so I can spend more time relaxing on the beach - it’s what consumes most of my time.

What was your journey that led you into trading?

I first got interested when I was studying economics - we had a local competition, sponsored by a bank, to see which team could make the most money from a theoretical investment. The team that I captained came third, and I was hooked. I dabbled with long-term equities and short term CFDs, for some years, before (much later) that I started with day trading, after a good friend started doing it.

What trading challenges are you currently facing and how do you have a plan to get through them?

The only real challenge is the automation of my trading - that just needs a lot of time and patience. Otherwise, I’m happy with where I am for my own trading and can’t think of any challenges.

What inspires you and what are your specific reasons to pursue trading?

I’m inspired by many things but specifically trading related: the ability to predict the movement of price and identify the price magnets and potential reversal zones. Trading is my job and I’ll do it for as long as I am able. It doesn’t matter how long one has been a trader, every day at the charts is another day at trading school. No two days are ever the same and each days presents its own challenges. The biggest buzz is from getting the very low pip/point risk trades, by watching the formation of price bars around a pre-determined reversal zone then hitting the buy/sell button at just the right time; those are the big R trades that we all seek each day.

In your head - The tricky topic of psychology

What’s the thing you enjoy most about working as a trader and what was your most painful experience?

Enjoy most: the high RR trades from low pip/point risk entries, as per previous comment. The most painful was selling my investments at the time of 9/11, for a massive loss, instead of just holding and riding the dip - I learnt a lot from that.

What are the key factors that separate successful day traders from those who fail?

The brain. If you can’t trade like a robot, devoid of any emotion, you will struggle to succeed. Emotional trading: fear of loss, fear of giving back a little bit of profit and locking too soon, revenge trading, lack of a plan for each trade, over-trading, etc. etc. the list goes on. A successful trader should have already determined where price is likely heading to then look to buy the dips/sell the rallies, to join the price move to the target, managing the trade with logic and none of the aforementioned emotional aspects.

How do you deal with frustration, self-doubt, and other emotional aspects of trading?

Take a break and do something else. Emotions can’t really play any part in your trading decisions but it’s always good to pat yourself on the back for a good trade.

We all have off days, days we really shouldn’t open the charts, do you have a process or criteria to understand if it’s a day to not trade?

I’m conscious of my thoughts: the voices in your head that are telling you when to enter a new trade. If those voices are defying logic / contrary to what the price is telling you / against the trading rules … you know it’s time to take 30 mins off for some mindfulness, or just to do something completely different. Just looking at the price action is often enough to determine if you should be trading or not, so at to avoid the off-days before you experience them.

Stategy and trading plans

What does you typical trading session, including pre and post, look like?

Pre-session: Multi-timeframe analysis, on the instruments that I’ll be trading, to identify likely direction, price magnets and PRZs; see what major news events are planned for the day. Trading sessions: generally restricted to a couple of hours per session, checking the higher timeframes occasionally, to keep the bigger picture in mind. Post-session: nothing in particular now. I used to review/update my journal but now use whatever spare time that i have to work on my trading robot.

What market or markets and time-frames do you trade and why?

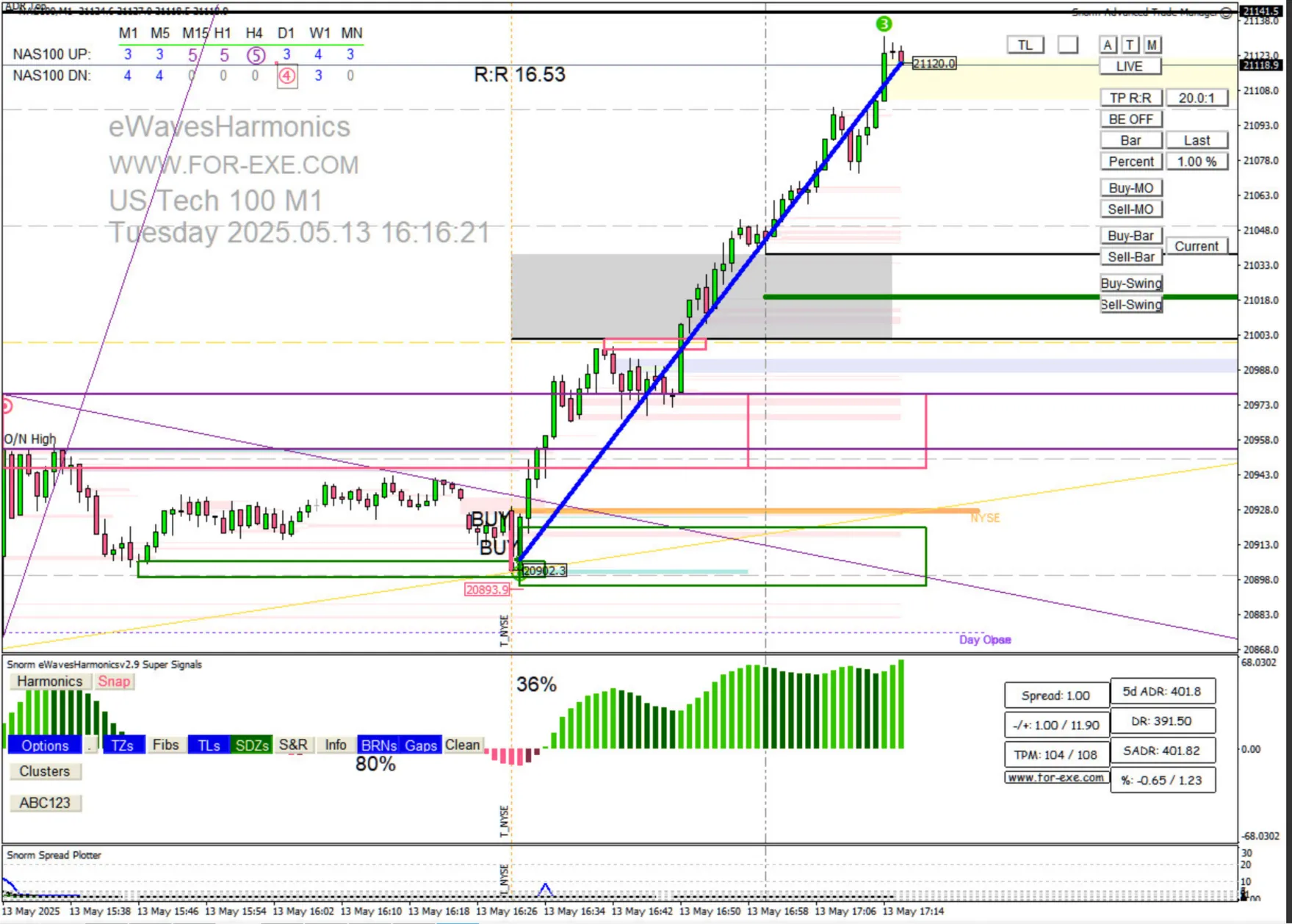

DAX / DOW / NASD the majority of the time - due to the spread/ADR value. I don’t trade a time frame per se but take entries from the M1 chart, for the best RR, with targets gleaned from any of the higher timeframes (M15 through to D1), although there will be times when I just use the M1 targets, if there’s enough RR potential in the trade.

What are the key indicators or charts you look at first thing in the morning to understand the market trend?

as per previous question.

Give 1 or 2 examples of your strategy explaining your reasons for entering the trade, how you managed the trade and your exit?

After identifying the strongest HTF price magnets, I look to enter on corrective moves at PRZs with a lot of confluence. Here’s a recent example. I had identified the M15 target zone 1 as the primary magnet for the session. I bought the dip, at demand, waited for price to make a significant move and correction, before moving my stop loss, then observed the price movement, locking profit where I thought price would not correct beyond: using support/demand levels and/or gaps that it created along the way. I closed the trade a bit earlier than the target, as it was approaching resistance and didn’t fancy having to ride a big correction. That is fairly typical of my trading - I will usually trail price bars when I have a good profit and price is close to target. For some trades, I enter in two parts - trying to get a lower point risk on the second - then might close one of those trades when it’s reached, say. 5R,. then let the other run, comfortable to allow more breathing room since profit has already been achieved for the session.

What platform, indicators and other tools you rely on for analysis, placing and managing a trade?

MT4/MT5 eWavesHarmonics, ABC123 indi, and other tools that I have written. Advanced Trade Manager for entries and trade management.

Do you have contact with other traders? Describe what you gain from this, how often you talk or share information and how did you find out about them?

Yes, every day in the trading group. I enjoy the company (trading can be a lonely game) plus it’s good to have plenty of eyes on the charts, to alert for good setups.

How do you adapt your trading strategies to different market environments?

When PA is slow or froggy, I will generally sit on my hands. I enjoy fast moving price action the most and try to focus my trading for those periods. The hardest thing is when there are no clear HTF price magnets, in which case I lower my RR expectancy and will perhaps grab 3 to 5R, if possible, rather than looking to be a pig.

Old Hands

How long did it take for you to really get trading down?

Many many years

If you could start over what would you do different?

Not spend a single penny with the plethora of scammers and not waste my time trying countless combinations of squiggly line indicators, hoping that I’d get the perfect entry every time.

Was there a notable time when you started to regularly make a profit? Was it a gradual process or lightbulb moment? Describe please?

Yes - when I started documenting all the things I knew / had discovered for myself about technical analysis. That eventually lead me to creating the trading course which crystalised everything in my mind. Writing indicators like eWavesHarmonics and the ABC123 indi also helped tremendously. Taking what the human eye sees and coding it in such a way that the computer can highlight what’s important, is quite a challenge and requires a great deal of logic. The constant testing, tweaking and analysis enabled me to create the trading tools for identifying the high-probability price magnets, the ideal PRZs and to document the numerous different setups that I use for entries.

What are the things that are going to separate you from the large majority of traders who fail?

think this was covered in a previous question - the mential attitude to trading.