· admin · Q&A · 6 min read

Dan

London Session DAX trader

Intro

I have been trading for around 4 years now. Trading mostly DAX from Frankfurt / London Open and occasionally NASD, EURUSD, GBPUSD, USDJPY

About me - Write a little about yourself

Brit, living in South Africa since 2009. Past work in electronics and IT.

What was your journey that led you into trading?

At the beginning of 2016 I found myself in position to buy a house. The money was in Euros and the purchase was in South African Rand. I put an offer in which was accepted and I exchanged the Euros into Zar for a deposit. The EURZAR fell and I did not have enough money to complete the purchase. I spent the next 3 months glued to the EURZAR chart. As a side effect I started learning the basics of trading from various trading guides. Luckily the EUR retraced the bear move, I starting bringing money over and we bought the house. This was the start of my learning. I then got interested in bitcoin and algo trading and I found after a lot of perseverance I had 2 fairly decent sized FTMO accounts with a profitable return, trading several Forex pairs overnight. Inevitable the crash came and one night, the markets was against me and the bot protection EA failed at the same time. I lost one account and put the other seriously close to the edge. I took a break and when returning I decided to learn to trade proper. I went from “guru” to “guru”. Eventually settled with one I liked and have benefited since.

What trading challenges are you currently facing and how do you have a plan to get through them?

The main challenge in my trading has been fear. This includes some FOMO, but mostly it is fear when I am in a trade. I have a strong urge to close trades early or move SL early to either avoid loss or to lock in a small amount of profit. With a Win/Loss ratio that is under 40% I need to be sure that my winners are decent and I recognize that this isn’t always the case. Awareness is the key here. Being honest with myself, being open with others and sharing my faults as well as my wins.

What inspires you to trade and what are your specific reasons to pursue trading?

I am driven by the challenge and really enjoy the psychological side of trading. Earning an income outside of the city grind is the other main one. It’s important I can work my own hours and at my own pace. I also love the discipline required and the lessons I learn about myself.

How many years have you been trading (hands on, not algo)?

More than 4 years

In your head

What’s the thing you enjoy most about working as a trader and what was your most painful experience?

Getting in on a LPR trade, executing the management well, coming away with something and knowing I did it right. The worst day was the one I talked about above, losing an account on algo trading overnight. I have also had some classic revenge day’s in succession and I ended up outside with a lot of screaming and even some tears.

What are the key factors that separate successful day traders from those who fail?

Discipline, patience, honest with yourself and realistic expectations.

How do you deal with frustration, self-doubt, and other emotional aspects of trading?

Not always that well. When I have self doubt it haunts me and I cannot trade properly. The best place to be, with this or any other emotion is somewhere other than the charts. One of my main focusses is recognizing these emotions before they cause harm.

We all have off days, days we really shouldn’t open the charts, do you have a process or criteria to understand if it’s a day to not trade?

Meditation is a good tool and I do have a check list and a pre-session where I write how I feeling, how I slept etc

Strategy and trading plan

What does you typical trading session, including pre and post, look like?

- Pre: Start writing on my real time journal, outlining where I am, where the price is, news etc. I open the charts on the higher timeframes D1, H1 and M15 to get an idea of potential reversals zones and targets for the session.

- Session: Take any trades as per plan, keep writing on online journal.

- Post: Wrap up, post-journal and review

What market or markets and time-frames do you trade and why?

DAX, Entry on M1, following M15 closely. I also keep an eye on H1 for reference. I trade DAX as it has low spreads on the broker I use and a good spread to ADR ratio. It also suits me to trade LO mostly.

What are the key indicators or charts you look at first thing in the morning to understand the market trend?

I use eWH for wave count, session indi and some of the other indicators.

Give 1 or 2 examples of your strategy explaining your reasons for entering the trade, how you managed the trade and your exit?

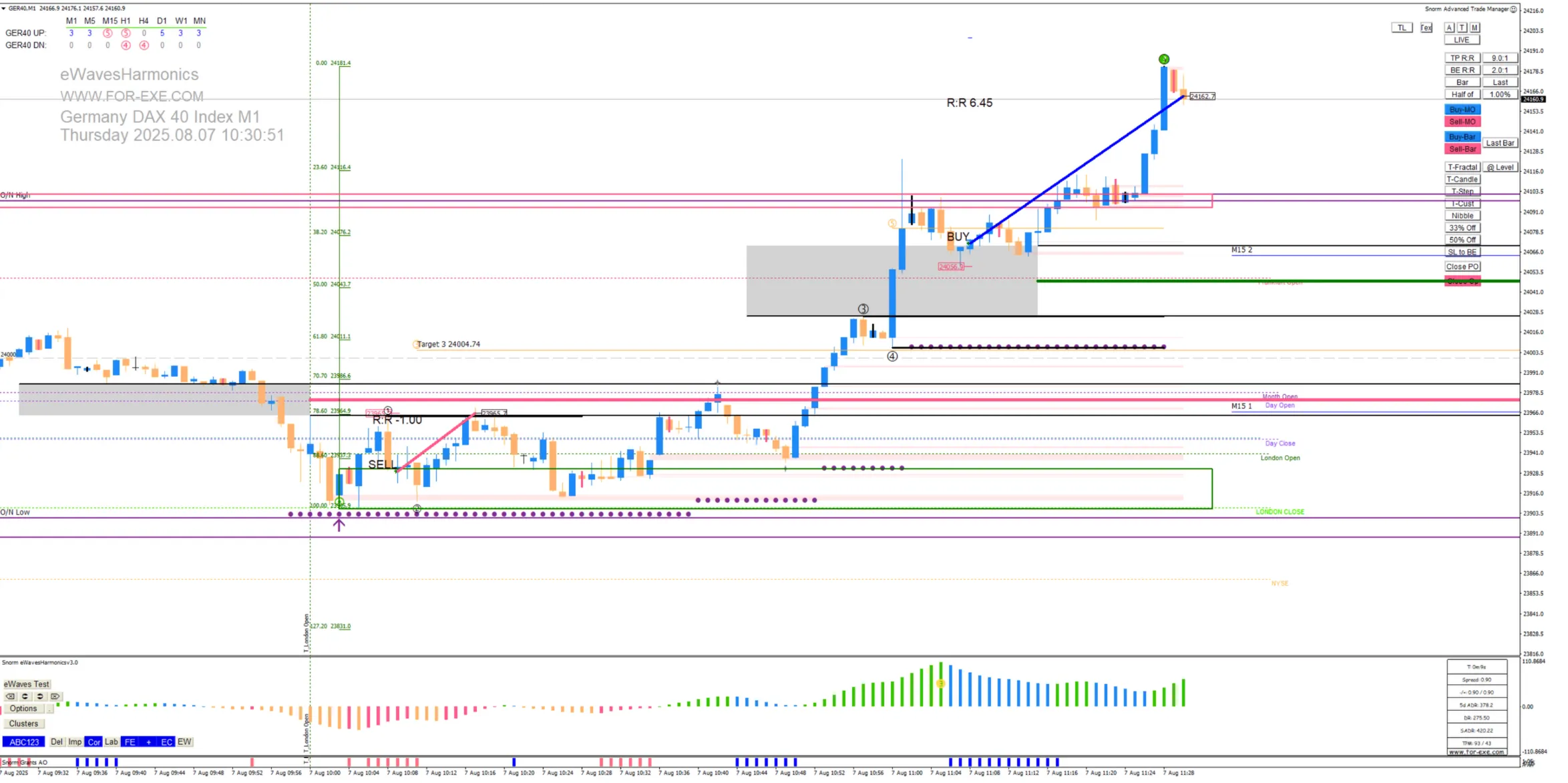

Here are a couple of examples from the last couple of weeks.  Above we see DAX (m1) testing the Overnight High after a impulsive move up and retracing to test M15 target zone and FVG. The impulsive move, ABC retrace, hammer and AC gave me confidence to enter the trade. I closed after a rejection at HTF fib level.

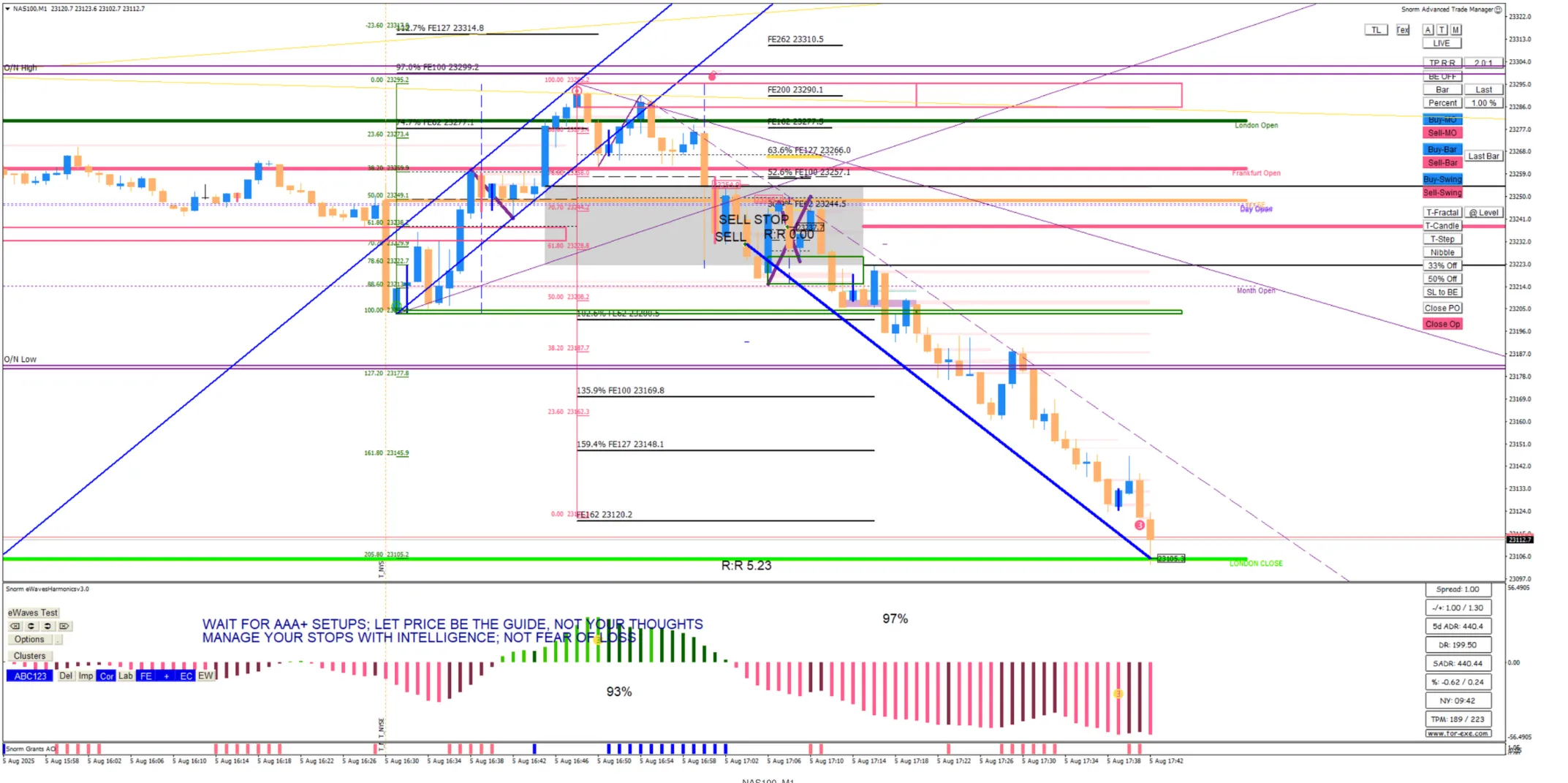

Above we see DAX (m1) testing the Overnight High after a impulsive move up and retracing to test M15 target zone and FVG. The impulsive move, ABC retrace, hammer and AC gave me confidence to enter the trade. I closed after a rejection at HTF fib level.  Next up is a NASD trade. A flip of the Day Close level and then a test of that level. Closed at London Close.

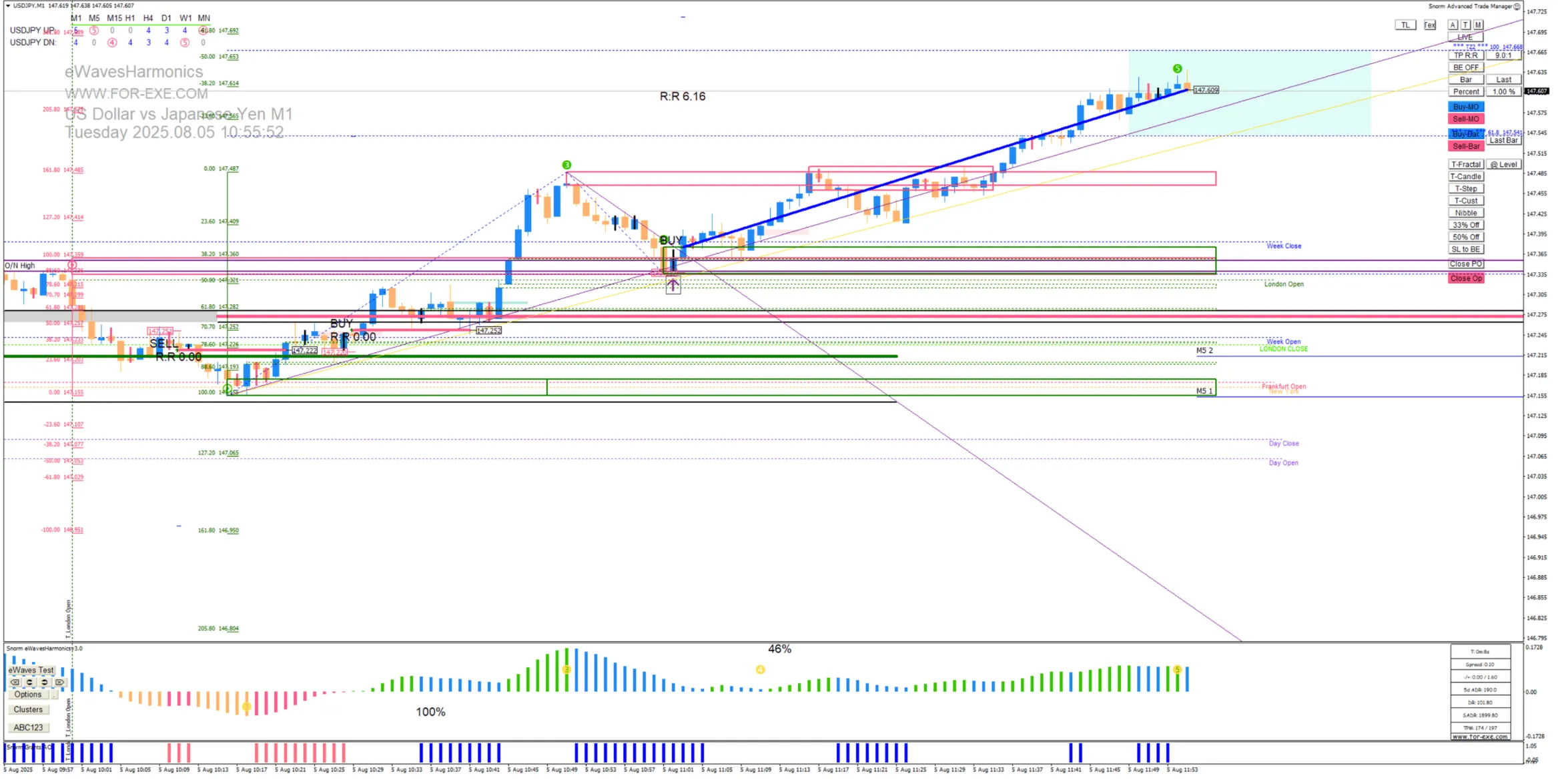

Next up is a NASD trade. A flip of the Day Close level and then a test of that level. Closed at London Close.  Lastly UJ we see flipping ONH after an impusive move up. ABC retrace to ONH, AC with IB. Entered on IB. Closed trailing candle after HTF level was hit.

Lastly UJ we see flipping ONH after an impusive move up. ABC retrace to ONH, AC with IB. Entered on IB. Closed trailing candle after HTF level was hit.

What platform, indicators and other tools you rely on for analysis, placing and managing a trade?

MT4, as mentioned above ewH and ATM for managing trades

Do you have contact with other traders? Describe what you gain from this, how often you talk or share information and how did you find out about them?

I’m in a chat group and share trades most days. This has been an invaluable resource emotionally and for my trading development.

How do you adapt your trading strategies to different market environments?

I like to see movement of the price and some flipping of levels before I look for a setup. If price is moving sideways or not clear than I stay out of the market. M15 is my go to gauge during a session.